How Much Money Did Wells Fargo Onate to the Arts Social Advertising

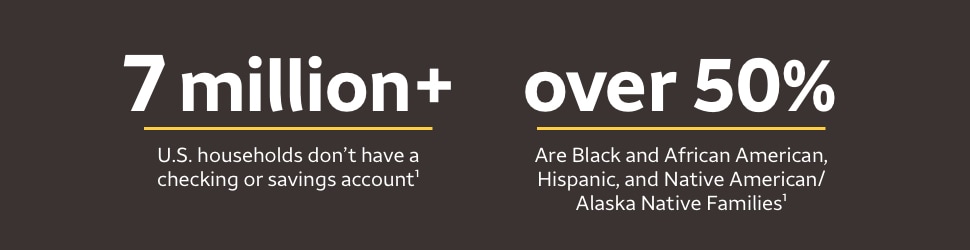

Nosotros're launching the Banking Inclusion Initiative, a x-twelvemonth delivery to accelerate unbanked individuals' access to affordable mainstream accounts and help unbanked communities have easier admission to depression-cost banking. We're focusing on Black and African American, Hispanic, and Native American/Alaska Native families, who account for more than than half of America'southward 7 1000000+ unbanked households. We're also assisting those who are underbanked and underserved, who may accept a bank account nonetheless still utilize high-cost, not-bank services.

Now is the fourth dimension to join a broad and diverse group of national and community stakeholders to accost long-standing inequities by increasing admission to digitally-enabled transactional accounts and financial wellness coaching. Through this initiative, nosotros also will interact with partners to explore solutions to the credit challenges facing unbanked individuals.

Come across our Wells Fargo leaders discuss the importance of accelerating financial inclusion. Watch the video

Access to affordable products and digital solutions

- Deepen our existing relationships with Blackness-owned minority depository institutions (MDIs) to support their piece of work in the communities they serve, including outreach efforts and providing the selection for their customers to withdraw cash from our ATMs and incur no Wells Fargo fees. In addition, nosotros are offer access to a dedicated relationship team who will work with each MDI on financial, technological, and product development strategies to help strengthen and grow their institutions.

- Continue to recognize that unbanked and underbanked individuals demand access to short-term credit. Nosotros're increasing funding and support to expand the Credit Builders Alliance (CBA) low-cost, credit-building consumer loan program. The arrangement's CBA Fund will provide patient loan capital, capacity-building grants, and technical assistance to their nonprofit lender members, enabling low-cost consumer loans for depression- to moderate-income (LMI) individuals to run across brusk-term cash needs and found or improve their credit scores.

- Increase awareness and outreach nigh low-cost, no overdraft fee accounts, such as our Clear Access BankingSM . We introduced Clear Access Banking in 2020 to offer an affordable account designed for those who are new to banking or have encountered by challenges opening or keeping a bank account. It's certified by the Cities for Financial Empowerment (CFE) Fund for meeting Bank On National Account Standards for safe and appropriate financial products to assist people enter or re-enter the mainstream financial system, and it gives full access to our nationwide branch and ATM network, and digital services.

- Broaden our collaboration with CFE Fund and local Bank On coalitions to pilot new strategies and approaches that help overcome barriers to banking access in several markets with high concentrations of unbanked households. The plan volition focus on helping those who are unbanked navigate the fiscal system, develop an easier, more seamless path for them to open a Bank On-certified account and access services they need within mainstream banking. Information technology will be used to identify best practices that tin be applied on a national scale.

- Piece of work closely with fintechs that are deeply committed to helping underserved communities. Nosotros're an investor in Greenwood, a digital platform for Black and Hispanic individuals and business concern owners. We are collaborating with the fintech MoCaFi to help provide banking to unbanked individuals, including offering MoCaFi customers the power to utilise their MoCaFi debit card at our ATMs without incurring fees from Wells Fargo.

Brand financial education and communication accessible

- Team with Functioning Promise to support the launch of HOPE Within centers within diverse and LMI neighborhoods, which volition foster inclusion through fiscal instruction workshops and complimentary one-on-one coaching to help community members accept control of their finances and build their credit scores.

- Partner with the Historically Blackness Colleges and Universities (HBCUs) Community Development Action Coalition to launch Our Money Matters, a comprehensive fiscal health initiative for college students of colour, who disproportionally face up greater financial challenges and college debt. This initiative aims to equip students with much needed financial adequacy skills and access to back up services. Over the next 3 years, the program volition aggrandize to 25 HBCUs and Minority Serving Institutions.

- With more than 25% of our branches in LMI community census tracts, we will introduce a new program within LMI neighborhood branches that volition be designed around the needs of the diverse communities we serve. The branches will feature redesigned spaces created to evangelize 1-on-one consultations, improve digital access, and offer financial wellness seminars, and through these efforts, will help build trust. We will select a set of pilot locations to innovate the programme, with a plan to aggrandize to 100 LMI neighborhood branches with a high concentration of unbanked individuals.

Launch a National Unbanked Advisory Task Forcefulness

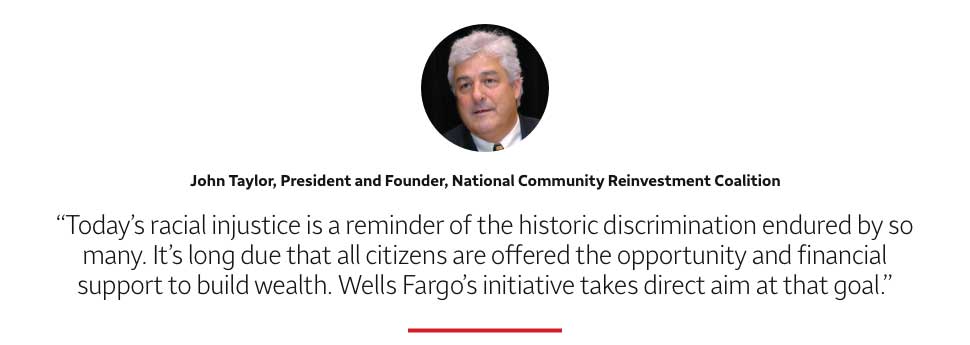

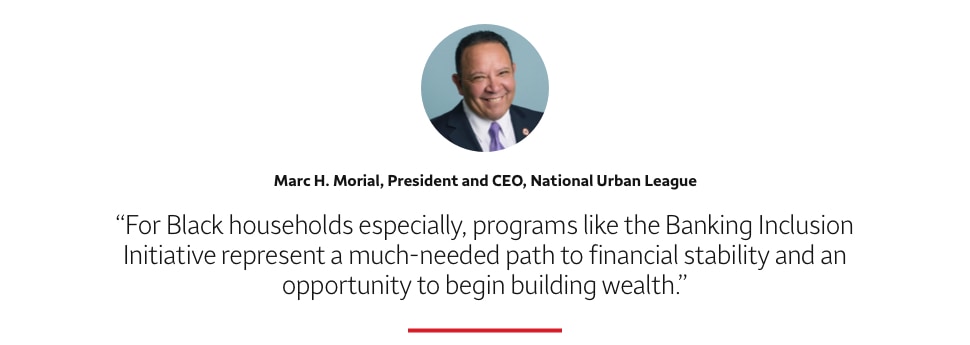

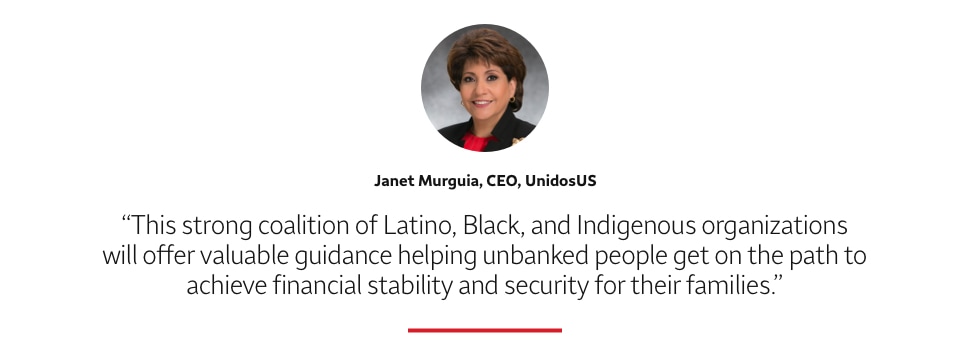

Establish and lead a broad coalition to assist with this multi-year commitment. This task forcefulness volition work with us to bring more people into the banking system from underserved communities, while likewise providing feedback on the initiatives that will be implemented and the best ways to measure success. The task force will feature representatives from Promise Enterprise Corporation, LULAC (League of United Latin American Citizens), NAACP (National Clan for the Advocacy of Colored People), NBA (National Bankers Association), NCRC (National Customs Reinvestment Coalition), NCAI (National Congress of American Indians), National Urban League, and UnidosUS.

Source: https://www.wellsfargo.com/jump/enterprise/banking-inclusion-initiative/

0 Response to "How Much Money Did Wells Fargo Onate to the Arts Social Advertising"

Post a Comment